Last Updated on July 12, 2023 by pf team

If you’re setting up direct deposit or setting up payments from your bank account, you may be asked for a voided check. Here’s how to void a check and the steps to consider before voiding a check.

In this article :

What is a void check?

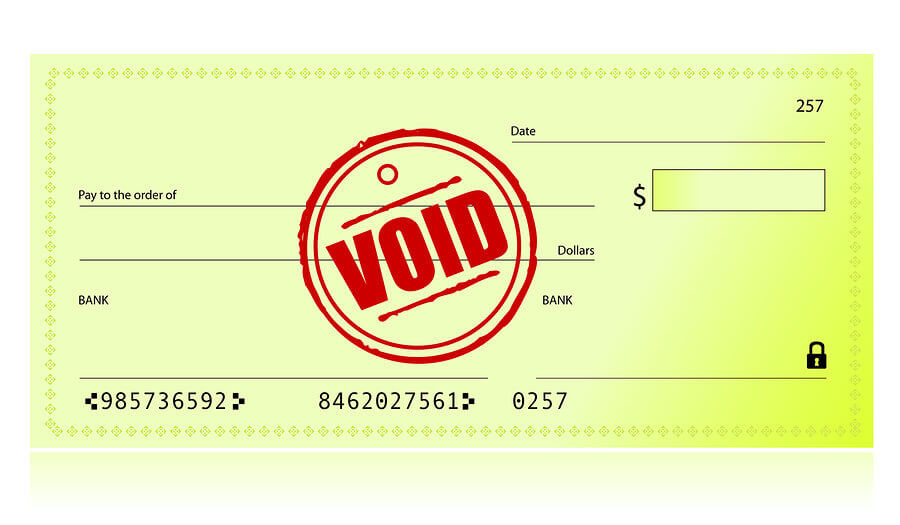

A voided check is a check that has the word VOID printed on it, whether handwritten or printed. The check cannot be presented for payment but still has information that can be used to verify your account and which bank holds your account.

How to void a blank check?

Voiding a check is easy but you should exercise some care if you need to void a check. Write VOID across the front of the check, but take care not to write over the numbers printed at the bottom of the check.

These numbers contain your bank’s routing number and your account number, both of which are needed for verification. Also, be sure to use ink that can’t be erased. Note the check in your checkbook or finance software, indicating that the check has been voided.

You can also take a photo or scan the check so you can use the same check for if you need a voided check in the future. Be aware that you can void a blank check or you can void a check that you’ve already filled out. However, once voided, the check can’t be used.

When to use a void check?

Certain types of transactions might require a voided check to verify your banking information. If you need to provide this info, you’ll often be asked to include your routing number and account number on a form but also to include a copy of a voided check.

1. Set up direct deposit or auto-pay

If you want to set up direct deposit with an employer, you’ll usually need a copy of a voided check.

While you’ll be asked to provide your bank routing number and account number on a form, your employer’s human resources department will probably need a copy of a voided check as well.

This process allows your employer to deposit your paycheck or expense reimbursements directly. Payment services may also require a voided check when setting up an account.

2. Set up automated loan payments

Many times, you’ll need a voided check to set up automated loan payments such as a mortgage payment, student loan, or auto loan.

Often you can earn a better rate by using automatic payments, so it may be worth the extra effort of setting up autopay and sending a copy of a voided check.

3. Set up automatic electronic bill payments

Other types of automatic payments may also require a voided check. For example, setting up autopay for your rent, utility bills, or phone bills may require a voided check if you choose to use a direct debit from your bank account.

Often, extra savings make the extra effort worthwhile. For example, many insurers offer an attractive discount if you make automatic payments.

4. Authorize a government agency to direct deposit your benefits

Much like with a direct deposit paycheck, you can set up direct deposit and have your benefit payments sent to your bank account electronically.

For federal benefits, there’s no extra charge for direct deposits. You can even choose to have your tax refund sent by direct deposit.

5. Correct mistakes

To err is human and if you make a mistake when writing a check, voiding the check is often the best way to fix the error. Be aware, however, that voiding a check happens before the check has changed hands or is presented for payment at a bank.

If you need to cancel payment on a check that has already left your hands, you’ll need to contact your bank.

What to do if you don't have any checks?

If you need to provide your bank account information but don’t have any checks, you may have some other options.

1. Your online banking account

An online checking account still uses checks, but if you’re out of checks, you may be able to send yourself a small check through your online bank’s bill payment service.

You can then void this check by writing VOID across the front and send it to the entity that requested a voided check. Alternatively, you may be able to print a check at home and then follow the same process.

2. Get a counter check from your bank

Counter checks are the same as the starter checks many banks provide when you open an account. These checks can be printed on demand and feature your bank’s routing number as well as your account number. Be aware, however, that some banks may charge a small fee for counter checks.

3. Get a letter printed on bank letterhead

In some cases, the entity requesting a voided check might accept a letter printed on bank letterhead. The instructions you receive will outline the information they’ll need on the letter. Expect to provide your routing number, account number, and your name.

Also, it’s important that this information is typed rather than handwritten. Most banks or credit unions should be familiar with the process and what’s required. The letter should also contain the contact information for the bank.

4. Use a preprinted deposit slip

In some cases, you can use a preprinted deposit slip to verify your banking information. A preprinted deposit slip has the same information as a voided check, including your name, routing number, and account number.

However, to avoid delays, it’s best to verify whether a preprinted deposit slip is acceptable in place of a voided check.

5. Use a direct deposit authorization form

Often, a direct deposit authorization form is the first part of the process when getting set up with direct deposit through an employer or for other types of payments.

It’s possible that some employers or payment providers might accept this form by itself. The form asks for the same information printed on a voided check, such as your name, routing number, and account number.

However, you’ll often find that you’ll need both an authorization form and some type of verification, such as a voided check.

6. Send a photocopy of a personal check

Reach out to the entity that requested the voided check. You may have other alternatives, such as sending a copy of a check that has already cleared your bank.

However, be sensitive to privacy issues. A cleared check may contain information that you or another party may prefer to keep private.

Important tips to consider when voiding a check

- Keep records of your voided checks in your check register. Indicate that the check is voided in your checkbook, check register, or finance software.

- Consider encrypting the image when you send a voided check electronically. If you can use a voided check to set up online payments, so can someone else who gets your checking account information. If possible, consider sending the check copy as an encrypted PDF. Also, reach out to be sure the receiving party can accept an encrypted file. Explain your concerns politely.

Voided checks FAQs

Can you get a voided check online?

If you don’t have a checkbook, you may be able to use your bank’s online bill pay service to send a small payment to yourself.

For example, you could send a payment for a penny and then mark that check as void. Alternatively, you can use check printing software to print a check you can then mark as void. Many of these apps are free to use or free to try.

Can I use the same voided check twice?

Yes, companies that request a copy of a voided check need to verify your bank’s routing number and your account number.

Since this information is on every check, there’s no need to void a second check if you need to show a voided check to more than one company.

Do you have to sign a voided check?

There’s no need to sign a voided check and it may be safer if you don’t. A voided check is simply used for verification of your banking information.

The requester only needs your name, account number, and routing number off the check.

How do you get a voided check without a checkbook?

If you don’t have any checks, one of the simplest ways to get a voided check is to visit your local bank and request a counter check.

These checks can be printed on demand and have the same information as a standard check, including your routing number and account number.

Why do employers need a voided check?

Employer’s use a voided check to ensure accuracy when setting up direct deposit. A mistake in either the routing number or the account number can create delays in payment and may lead to other costs.

How do I set up direct deposit without a voided check?

Reach out to your human resources department to ask which alternatives they offer. For example, they might accept a bank letter or a voided preprinted deposit slip as verification of your banking information.

What is a preprinted voided check?

When an employer or another entity requests a preprinted voided check, they are probably referring to a standard check that you have voided by writing VOID on the check.

Reach out to the requester if you have any questions regarding documentation they need.

Is it safe to send a voided check via email?

Email isn’t always secure and using email can put your information at risk. If possible, consider sending the check in an encrypted PDF. This step keeps parties who don’t have the password from viewing the document.

Can I get a voided check from my bank?

You can request a counter check from your bank. Some banks charge a fee for this service. Once you have the check, use ink or a permanent marker to write VOID on the check. Be careful not to write over the numbers at the bottom of the check.

Can you void a check after sending it?

You can void a check you have in your possession. If you’ve already sent a check, you can request a stop payment on a check if you’ve made an error or don’t want the payment to complete for another reason.

Typically, banks charge a fee of up to $35 for a stop payment request.

Can you cash a check with VOID written on it?

Most tellers won’t cash a check that has been voided but there have been cases of voided checks that have been cashed. When sending a voided check, it’s best not to sign the check and to send only a photocopy or photo of the check.

Is a direct deposit form the same as a void check?

No, although it’s common for both a direct deposit form and a voided check to be required and while both have similar information, they are not the same. The voided check serves as a verification of your routing number and account number.

Final thoughts on how to void a check

From employers, to payment services, to government agencies, requests for voided checks are still common. However, keep your own security in mind when sharing banking information.

If your routing number and account number fall into the wrong hands, there’s a possibility that this information can be used to make payments, purchases, or other unauthorized activity.

Consider using a password-protected PDF if sending your information by email.