Last Updated on July 23, 2023 by pf team

How to start investing when key market indexes like the Dow and the S&P 500 are near all-time highs? It’s easy to think you may have missed the boat and that it’s too late to start investing.

In reality, the stock market has been hitting all-time highs since it’s inception, eventually surpassing those highs and then climbing even higher.

Nothing moves up in a straight line, however, which means there is risk — but there are ways to mitigate investment risk and there are also viable alternatives to stock market investing.

In this article :

Why investing?

Saving money is safe. You’ll earn interest on your savings and FDIC insurance protects deposits for up to $250,000 per depositor per bank.

Investments, like stocks or mutual funds, come with no guarantees and there’s a distinct possibility that you can lose money.

The stock market crash of 1929 ushered in the Great Depression. The DotCom boom and bust left many tech investors virtually penniless.

The financial crisis of 2008 halved the value of many retirement accounts, forcing some retirees back into the workforce.

Why — with the obvious risks — would anyone invest instead of simply saving money?

To make sense of investing and why you might choose to invest instead of just saving, it’s helpful to look at the bigger picture.

Saving is safe in most cases, but where savers often find risk is in inflation.

During a period of lower interest rates, the interest you earn on your savings is usually less than the rate of inflation.

This means you’re losing purchasing power by saving if the interest rate is low.

Many types of investing overcome the inflation hurdle, providing higher long-term returns — but it’s often important to take a 1000-foot view.

Markets can go up and down and sideways but over time, the trend for the broad stock market has been up and the average rate of return has been significantly higher than the average interest earnings on savings.

NYSE, NASDAQ, and AMEX stock exchanges

You may have heard of the NYSE, NASDAQ, or AMEX.

These are all stock exchanges that are part of the larger stock market, with the tech-heavy NASDAQ exchange being the newest and the AMEX exchange being acquired by the NYSE in recent years.

Each exchange has certain stocks or funds that trade on that exchange. The individual stocks on the exchanges have risk.

Any of these stocks can go to zero in a matter of days — or they might triple in price in a year, although neither scenario is very likely.

However, when you look at an exchange as a whole, you’ll see a trend that provides a different perspective.

NYSE

For example, the NYSE Composite is an index that measures the performance of all the stocks traded on the New York Stock

Exchange, which with more than 1,900 stocks is still the largest stock exchange in the world by market value.

In 1965, the NYSE Composite was at just over 500. Fifty years later in 2015, the NYSE Composite had reached over 9,500 and has continued upward to nearly 13,000.

During a 50-year period, the compound annual growth rate for the exchange was 6.65%, much higher than you could earn with most types of savings accounts.

A big picture view is also helpful because you can find numerous examples during that 50-year time span where the NYSE Composite went down, and sometimes considerably.

NASDAQ

The same is true for the NASDAQ Composite, which didn’t exist 50 years ago, but which also has peaks and valleys with an overall upward trend.

In the 40 years between 1979 to 2019, the NASDAQ Composite has risen from 138 to over 8,000, a compound annual growth rate of 10.68%.

The NASDAQ index might go down tomorrow or it might go up again. The day to day fluctuations are less important than the overall trend.

Standard & Poor's 500

On a smaller scale than some exchanges, but still well-diversified, the Standard & Poor’s 500 index tracks the 500 largest publicly traded companies in the US.

In many ways, the S&P 500 represents the North American economy, and the index has treated investors to an annualized average return of about 10% since its inception.

With index funds or exchange-traded funds, it’s possible to target these indexes as opposed to individual companies.

Through diversified investing and with a longer investment horizon, stock investing historically provides much higher average returns than traditional savings vehicles.

However, both components — diversification and time — are essential for reduced risk and higher long-term gains.

Choose your investment strategy

Just like there may be more than one way to climb a mountain, there are many ways you can choose to invest — and not all of them involve purchasing stocks.

Some investment strategies are built around income, while others are built around growth in value.

You can also have long-term investments, short-term investments, or a mix of both.

#1 Buy and hold investing

Billionaire stock investor Warren Buffet is famous for saying his favorite holding period for the stocks he buys is forever.

While that approach isn’t always realistic or the best strategy for stocks in companies that are becoming obsolete, it does explain the overall returns of the broad market indexes when viewed over decades.

The long-term trend is up. Buy and hold investing is exactly what it sounds like. With this strategy, you would buy a stock and just put it away.

Years later, if you chose well, the stock may be worth quite a bit more — and you didn’t need to time your trades or read the financial journals every day.

Buy and hold strategies can be used with any type of stock, index, or mutual fund, and removes much of the stress from investing.

Buy and hold investing is often combined with value investing, in which you buy a stock that is undervalued in regard to its earnings per share and just wait until the share price rises.

#2 Growth investing

Growth investing focuses on companies that can offer above-average growth, even if the short term price of the stock may look expensive when viewed in terms of price to earnings or price to book value.

Amazon and Google are both modern-day examples of growth stocks that rewarded early investors.

Amazon lost money for the first several years after the company went public.

From a value investing standpoint, there wasn’t much measurable value to be found in the now-massive online retailer.

There was, however, earnings growth potential. Losses in the early years for Amazon later became small earnings, which then became significant earnings.

#3 Dividend investing

Many companies share profits with investors in the form of dividends, which are payments to shareholders, often made quarterly.

Dividends can be generous, like in the case of real estate investment trusts (REITs), or can be a more conservative percentage, which strikes a balance between rewarding stockholders and conserving working capital for the company’s continued growth.

The S&P 500 index includes many companies that pay a dividend, which has helped the index’s returns significantly.

Long term, the index has paid an average dividend of over 2% in addition to long term gains in the price of the index.

Several well-known and financially stable companies in the Dow Jones Industrial Average, an index that tracks 30 large American companies, also pay dividends.

Choosing to invest in either of these indexes pays dividends while also providing some diversification and the safety that often comes with investing in larger companies.

To increase dividend income above 2%, you may need to take a more focused approach and invest in companies that provide a higher dividend yield.

An investment approach which targets blue-chip stocks with higher dividends and may also provide some value-investing opportunities is a strategy that became well-known in the early 90s, called Dogs of the Dow.

This strategy targets the 10 stocks in the Dow with the highest dividends, which then creates a higher dividend yield than investing in the Dow index or the S&P, both of which have stocks that may not pay a dividend at all or pay a lesser yield.

Real Estate Investment Trusts (REITs) are another common choice for dividend investors. However, you’ll find less diversification in this strategy than in a strategy that targets several types of companies.

If the real estate market is struggling, as it did for several years following 2008’s real estate crisis, you may see the share prices on these equities start to falter, which can make the dividend yield look even stronger.

Generally speaking, if the yield seems too good to be true, there’s often a reason — and it could be an indication that your investment capital may be at greater risk.

#4 Investment crowdfunding

Kickstarted by the Jumpstart Our Business Startups (JOBS) Act in 2012, investment crowdfunding has been modernized and several online platforms make it easy for investors to invest in startups or small businesses, with the possibility of finding the next big thing.

SEC regulations may limit the amount you can invest based on your income.

Real estate crowdfunding platforms often have a higher minimum investment of between $5,000 and $10,000, which combined with SEC rules can prevent some would-be investors from participating in real estate crowdfunding.

Other platforms may require a minimum investment per company of $1,000 or more.

Like a micro version of the stock market, many platforms allow either direct investment in one company or small funds that may include 10 to 15 companies in a given sector, like biotech or retail.

One appeal of investment crowdfunding is the ability to invest in companies before they make it big.

This also introduces a fair amount of risk because BLS statistics show that nearly 70% of businesses don’t make it past the 10-year mark.

In stock market investing, business failure rates are less concerning because it’s often easier to keep up on news regarding the stocks you own and it’s usually much easier to exit a position. You simply sell your stock.

With investment crowdfunding, you can’t cash out your investment on a whim. Instead, you have to wait for the company or fund to begin paying out quarterly dividends, assuming there’s a profit to share.

#5 Peer to peer lending

Another alternative to stock market investing with potentially high returns, peer to peer lending bypasses banks as lenders and allows investors to make loans to businesses or individuals.

Like investment crowdfunding, you may find investor restrictions based on income or net worth, Membership in a lending platform may also be subject to state rules.

Prosper pioneered peer to peer lending in 2005 and remains one of the largest platforms in the space.

Other lending platforms, like Lending Club — currently the largest platform, now provide additional options and different structures.

Minimum investment amounts range from $25 to $1,000 or more and as peer to peer lending has evolved, you can expect useful tools to help you understand both the opportunity and risk that accompanies a loan.

In some cases, you’ll have the option of funding a loan directly, while in other cases, lenders are pooled to fund a loan or group of loans.

As you might expect, higher returns are often associated with higher risks.

However, the relative ease of entry and the number of higher-quality borrowers available make peer to peer lending a viable alternative to both interest-bearing deposit accounts and stock market investing.

Use the power of compound interest to grow your investments

When your interest is earning interest, your investment can grow impressively — but a key requirement is time. Compound interest refers to when your interest or investment gains earn more interest.

To look at a quick example, if you had $1,000 and you were earning 10% per year, this is what the math might look like:

- Starting balance: $1,000

- Year 1: $1,100

- Year 2: $1,210

- Year 3: $1331

- Year 5: $1610

- Year 10: $2594

In the first year, the interest was $100. If all you earned each year was $100, you’d have $2,000 by the end of the 10-year period.

In this example, you have an extra $600 because your interest is earning interest as well.

This is a simple example and doesn’t fully mirror real investment performance for a number of reasons, the primary reason being that we never added to the balance.

Another key factor is that the time frame is limited.

Let’s look at some additional examples where we put money into an investment account consistently each month — but stop after a certain amount of time.

Example #1 : A 25 years old who invests for 10 years

In the first example, imagine you’re 25 years old and can spare $200 per month for retirement investments.

You’re putting money into a tax-deferred account, starting with a $2,400 initial investment, so taxes on dividends don’t apply (yet) and the account can grow without any headwinds.

One consideration, however, is that you stop investing at age 35 in this example.

Any growth after that time isn’t aided by additional investments, but you’re earning an average 10% annual return throughout, including dividends, which you can automatically reinvest.

- Starting balance: $2,400

- Year 1: $5,280

- Year 5: $19,982

- Year 10: $48,299

At this point, you’ve invested $2,400 each year for 10 years, plus your initial investment of $2,400, which equals $26,400.

So far, you’ve made $22,000 on your investment. Now, you’re 35 and decide to stop investing.

The $48,299 in your account continues to grow at an average annual return of 10%.

Here’s what the balance would look like over time:

- Age 45: $125,275

- Age 55: $324,931

- Age 65: $842,788

Not bad. You grew a $26,400 investment into nearly a million dollar balance, just by earning a 10% return and letting compound interest work its magic.

Example #2 : A 40 years old who invests for 25 years

Let’s look at another example. In this case, you started investing later — at age 40 — but you are able to keep investing until you are 65.

To keep it fair, we can assume the same starting investment ($2,400), the same monthly investment ($200), and the same average annual rate of return (10%).

Here’s what the numbers would look like after 5-year intervals:

- Age 40: $2,400

- Age 45: $19,982

- Age 50: $48,299

- Age 55: $93,904

- Age 60: $167,352

- Age 65: $285,639

You can see the trend early on. Even when making a monthly investment for an additional 15 years, there just isn’t as much time for the gains to compound, which results in a much lower balance.

Investment gains like those in the examples are possible — and you don’t have to be an investment guru to realize similar returns.

In fact, the S&P 500 has provided a similar average annual return since its inception.

An index exchange-traded fund or mutual fund that tracks the S&P would provide returns that closely mirror the S&P’s performance.

Time also helps to smooth the trend line. Over shorter time periods, investment returns are less predictable.

Why diversification and asset allocation are important

Investing can be risky. In the history of the US stock market, there are countless examples of well-known companies whose stock values dropped dramatically, some even going out of business altogether, decimating investment portfolios in the process.

Diversification

Diversification is the investment equivalent of the same wisdom shared by your parents or grandparents when they said don’t put all your eggs in one basket.

If that one basket falls, all the eggs are broken. The same concept can be applied to investment sectors.

If you follow market news and stock prices, you’ll quickly learn that economic or political factors can affect share prices for the broad market.

However, you’ll also see that some parts of the market can be more affected than others.

News, events, or even uncertainty can affect the share price of individual companies or of all the companies in the same sector.

Rising interest rates or mortgage default rates may cause homebuilder stocks to fall, for example.

These aren’t conditions that will turn around overnight, so they could affect stock prices for an extended period.

If all of your money is invested in homebuilder stocks, it might take a very long time to show a positive return.

Asset allocation

Asset allocation refers to the idea of distributing assets according to your risk tolerance and investment goals and is closely related to diversification.

For example, as you approach retirement, you may want to allocate more of your savings to more conservative investments, like bond funds.

Leaving all your money in stocks, even when diversified, can still have risk and there may not be much time before retirement for stock prices to rebound if the market dips.

During the bear market of 2007-2009, the S&P — a well-diversified index — lost about half of its value.

Stock diversification wasn’t enough to protect investors, but asset allocation can help protect savings. Here are some simple examples of different types of portfolios.

- Low-risk portfolio: In a low-risk portfolio, it’s common to use bonds or bond funds to protect your investment. A mix of 70% to 100% bonds or cash reserves is common, with the remainder being invested in diversified stocks.

- Balanced portfolio: A balanced portfolio takes the middle ground, with stocks and bonds often at close to a 50-50 split in regard to allocation. If you had $600,000 in investment savings, you might have about $300,000 in each investment category.

- High-risk portfolio: Also called a growth portfolio, a high-risk portfolio is often best suited for younger investors who have more time for investments to recover if stock prices fall. Typically, bonds make up no more than 30% of the entire portfolio or may not be represented at all. A high-risk portfolio puts its focus on stocks.

Decide what do you want to invest in

During your investing lifetime, it’s likely that you’ll own several types of investments.

Bearing in mind that investments have no guarantees and that you can lose all or part of your investment, you’ll need to choose how to allocate your investments.

- Stocks: Purchasing individual stocks is how some famous investors, like Warren Buffet, made their fortunes. Buying individual stocks requires considerable research and carries more risk than some other investment options, but can also be more rewarding if your stock picks perform well.

- Mutual funds: If you prefer that a fund manager or a management team choose your stocks, mutual funds are a viable option. Expect to pay a management fee as part of your investment, which can create a drag on investment growth.

- Bonds: Arguably among the safest investment types, bonds can be a good way to earn a small return while protecting capital. Many mutual funds own both stocks and bonds.

- ETFs: Exchange-traded funds (ETFs) are a popular way to invest in sectors or indexes while maintaining liquidity. Because ETFs are traded on stock exchanges, buying or selling ETFs avoids many of the restrictions common to mutual funds.

- REITs: Real Estate Investment Trusts allow you to profit from owning properties without having to fix any leaky faucets. The trust owns and manages the properties and you buy share shares in the trust. Dividends are a strong attraction with REITs.

- Index funds: Many managed mutual funds don’t consistently beat the returns for the S&P 500 or some other indexes. An index fund is designed to track an index and can follow broad indexes or specialized indexes. Costs are often lower because this process can be automated.

- CDs, MMAs: Traditional savings vehicles deserve a place in a well-balanced portfolio. CDs and money market accounts provide a safe way to save and are protected from market swings.

- Futures and options: More advanced investment strategies can involve futures trading and options, which allow you to control an asset without actually buying it. You’ll want to research the topic well before jumping in because options can involve using credit or putting a deposit at risk. Some investors use options to hedge their investment and others use options to bet against a stock, commodity, or index.

- Cryptocurrency: The number of cryptocurrencies is growing — but a similar number of cryptocurrencies have already failed. Others see little trading activity or price movement. Still, there are cryptocurrency millionaires among us. Research your investment choices, consider asset allocation, and be mindful of liquidity. Cryptocurrency prices can be much more volatile than other types of investments.

Decide where you want to hold your investments

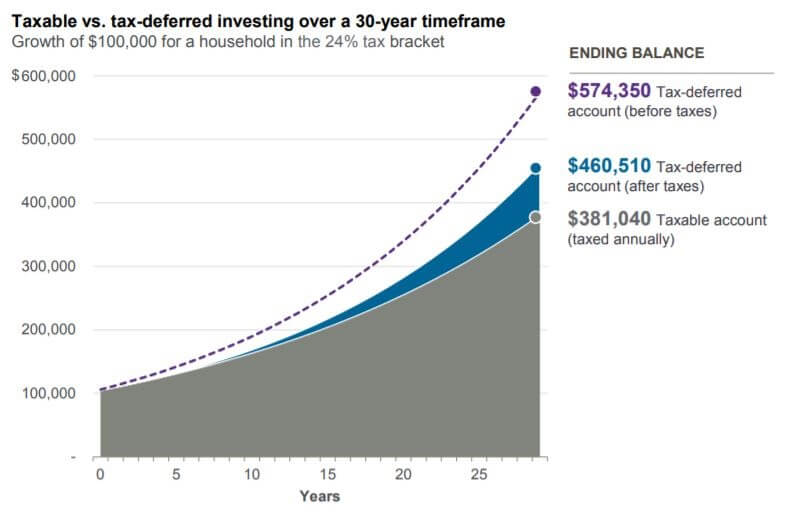

Where you choose to hold your investments can make a big difference in long-term growth as well as access to funds.

Retirement accounts have tax advantages that can help your money grow faster or provide tax-free retirement income. Taxable accounts provide easier access to your investment funds.

Sheltered accounts

- Traditional 401(k): A traditional 401k is an employer-sponsored retirement plan. Often employers offer matching contributions, which can help build your retirement savings much faster. 401k investments and dividends are generally not taxed until withdrawal.

- Roth 401(k): A Roth 401k is funded with after-tax earnings but qualified withdrawals from a Roth 401(k) are tax-free at the time of withdrawal.

- Solo 401(k): Also known as a self-employed 401(k), a solo 401(k) provides tax-deferred benefits similar to a traditional 401(k) and was designed for business owners with no employees besides the business owner and their spouse.

- 403(b): A 403(b) plan is functionally similar to a 401(k) plan, with a primary difference being availability. 403 b plans are used by non-profit companies, religious groups, school district, and government organizations.

- Traditional IRA: Traditional IRAs are commonly available and offer similar tax-deferment benefits to a 401k. Contributions to a traditional IRA are tax-deductible, subject the phase-out limits or other restrictions.

- SEP-IRA: A SEP-IRA is a simplified employee pension funded by employers on behalf of business owners and employees.

- Simple IRA: a simple ira is similar to a traditional ira has higher contribution limits and is designed to benefit small business owners and their employees.

- Roth IRA: Much like a Roth 401k, a Roth IRA is funded with after-tax earnings and both principal and gains can be withdrawn tax-free at retirement.

- 529 college savings: Named after section 529 of the US federal tax code, a 529 college savings plan is exempt from federal taxes and can be used to pay for several types of education-related expenses.

Taxable accounts

Taxable accounts also known as brokerage accounts, do not have the tax advantages of sheltered accounts but provide easier access to your investment money, which can be a strong consideration for some investors.

Expect to pay taxes on dividends and on gains from completed trades.

Trust funds

Trust funds can be a great way to build wealth for future generations and stocks, bonds, real estate, and mutual funds, are among the many types of assets that could be held within a trust fund.

Open an investment account and set up an automatic transfer

Consistent investing is often key to investment growth, so you’ll want an account that allows you to transfer money automatically.

In effect, you’re paying yourself first, transferring funds before the money can be spent on things you probably don’t need or that won’t benefit you as much as building a secure future.

Online discount brokerages

Online brokers can provide cost-effective trades, access to popular mutual funds, access to bonds, and the ability to trade stocks or ETFs.

Today’s brokerages offer educational tools, stock or bond screeners, automated investing, and support either individual accounts or sheltered college or retirement accounts.

- Ally Invest: With some of the lowest trading fees in the industry and the option of self-directed trading or managed portfolios, Ally proves worthy of its name as a trusted online brokerage. Expect a wide variety of investment choices, including commission-free ETF, bonds, and popular mutual funds.

- TD Ameritrade: A modern and well-respected online broker, TD Ameritrade leverages over 40 years of brokerage experience to bring investors a feature-filled platform with streamlined expenses. Web and mobile apps or a downloadable platform bring portfolio management with you wherever you are an investors can choose from a broad range of investment options, ranging from mutual funds for forex trades.

- Merrill Lynch: With self-directed investing, guided investing, or the assistance of an advisor, Merrill Lynch provides tools to benefit investors of any experience level. Affordable trades coupled with Merrill Edge Market Pro provide analysis and insight without high trading costs that can slow investment growth. Mobile and desktop platforms assure that you can stay nimble and trade at home or on the go.

Robo advisors

Human advisors have their role in investing, but a high-tech approach can help level the playing field and bring affordable portfolio management to investors of all levels.

- Betterment: Working for a small percentage charged annually, Betterment offers trades and portfolio rebalancing at no additional charge. You can choose to optimize your portfolio based on growth, safety, or diversification, and take advantage of automated tax-saving strategies that time trades to maximize tax benefits. Betterment’s Smart Saver account also provides outsized returns on the cash you’ve put aside while planning your next move.

- Wealthfront: With a focus on low-cost index funds, Wealthfront automatically optimizes your returns while respecting your comfort level and allocating investments according to your risk tolerance and goals. Wealthfront’s technology-driven approach means you’ll never need to overthink your investment choices. A small fee charged as an annual percentage lets you keep the momentum growing without the headwinds of high expenses.

- Wealthsimple: True to its name, Wealthsimple features zero-maintenance portfolios built with low fee funds, minimizing the overhead that can affect investment performance. Choose your preference, conservative, balanced, or growth — along with several steps in-between, and then Wealthsimple goes to work, investing in a mix of low-cost ETFs that help you reach your investment goals.

Commissions and fees associated with investing

Investment costs have come down considerably overall in recent years, but you’ll still want to check the fine print. Not every platform or fund is well-optimized to minimize fees and management overhead.

- Account maintenance fees: An account maintenance fee can apply for lower balances or for any activity with some brokers.

- Management or advisor fees: A fee for portfolio management or advisory services can apply, depending on your portfolio structure.

- Trade commissions: Frequent traders should pay special attention to trade commissions, which can put a dent in overall portfolio performance.

- Mutual fund loads: Charged at the time of purchase or at the time of sale, mutual fund loads or a commission paid to the brokerage.

- 12b-1 fees: A 12-1 fee is a marketing or advertising fee charged by a mutual fund.

Other fees may apply, depending on the type of trades you make or the type of investments you make. Take the time to educate yourself and do the math to be certain the fees don't adversely affect the overall value of the investment.

When you start investing consistency plays a key role

Investing plays a key role in building a long-term secure future.

By starting early, you'll have a greater opportunity to build through investment compound growth and your portfolio can better weather the market’s short-term turbulence.

Consistency also plays a key role, so choose a strategy built around automated transfers to your investment account, which you can then allocate as needed.

Keep diversification and asset allocation in mind.

For every stock market success story, there are thousands of untold stories in which investors lost money due to insufficient diversification or by not staying mindful of asset allocation.